- An Ecosystem Built for Seniors

- Smart Contract-Powered Retirement Planning Platform

- Purchase Bitcoin with Your 401k or IRA

- Cryptocurrencies for Retirees

Now There Are Cryptocurrencies for Retirees as Well

First, we had to get used to Grandma having a mobile phone. And, we all know the only thing worse than no one liking your Facebook post is getting a thumbs up from Grams. Don’t be too quick to dismiss the older generation when it comes to tech, though. In fact, now there are cryptocurrencies for retirees as well.

It may be hard to conceive of retired folks in a nursing home debating whether to HODL or cash-in while playing dominoes. But, according to a report by WorldPay, the baby boomer generation is reshaping the global online payments industry. They’re buying more stuff online, and a cryptocurrency for retirees could be the next logical step.

Vendors often overlook this demographic, desperate to win over millennials. Yet these “silver surfers” have better health than generations before them–and substantial spending power. In fact, global online spending by consumers aged over-60 is expected to reach $15 trillion by 2020 (twice as much as 2010).

They’re getting better at managing their iPhones. They’re starting to buy Alexa. And, they’re slowly opening up to the concept of Bitcoin. It won’t be long before seniors are financing their retirement with cryptocurrency too.

Check out some of the latest ideas for blockchain and cryptocurrencies for retirees.

An Ecosystem Built for Seniors

The population is aging. According to a report by the United Nations, in 2015, one in eight people globally was 60 years or older. By 2030, that ratio increases to one in six, and by 2050, at least one in five people will be aged 60 or over.

It’s great that we can look forward to a longer life. More time to play golf, head to Florida, maybe even play Bingo. This is the first thing I should do among others. But with a reduced birth rate and fewer young people to shoulder the burden, that places a major strain on resources. Clearly, there’s a need for an efficient support system for the growing senior population.

GladAge is an ecosystem built for seniors to provide personalized care and fully vetted senior homes. CEO Sunny Kapoor says, “On the GladAge platform, the control is handed over to the seniors as they select the type of care needed, shop for equipment or services and even review caretakers who they can hire on demand.”

GladAge seeks to solve the sector’s biggest problems that the traditional systems have failed to resolve. “Lack of senior homes, a severe shortage of trained workers, unorganized market structure and chaotic processes are a few to name,” says Kapoor.

“There is a huge gap between the care homes available and the number of care homes needed,” Kapoor explains. “Even the ones that are available are not fit for the purpose and often lack the desired standard to provide a homely atmosphere.”

If you’ve ever stepped into a state-run senior care facility, you’ll know what he’s talking about.

Most countries’ national resources are stretched and non-government institutions work with limited resources. In many cases, there’s simply no mechanism to evaluate the quality of their services. “This translates into mental and physical woes for our senior citizens,” he says.

To add insult to injury, most caregivers aren’t properly vetted. A cursory check may reveal an ex sex-offender or thief. But, what about their reputation and suitability as a caregiver? After all, who wants to be manhandled by a sour-faced bint, or a frustrated Sergeant Major?

“Non-profiling of caretakers leads to a market phenomenon of ‘anything is fine’,” says Kapoor. “A Scoring system brings in healthy competition among the stakeholders–to maintain their prosperity and livelihood they must perform well at their jobs. “The purpose on which GladAge thrives is to design a decentralized senior care sector equipped to evolve dynamically. It does so by introducing the most futuristic technology in a traditional industry that’s over a century old.”

Smart Contract-Powered Retirement Planning Platform

When Bitcoin came into the public conscience, it was pretty hard to imagine that in a few short years, cryptocurrency would be solving major word problems. Or that there would be cryptocurrencies for retirees.

But the US retirement industry alone is worth around $27 trillion. So it makes sense that blockchain companies will look more toward this space.

We all know that we need to save for our retirement, but many millennials are still struggling with student debt–and many boomers are struggling with their kids’ student debt as well. Most Americans don’t save enough for their retirement, which sets them up for a less-than-appealing future.

Added to that, current retirement plans are owned by a central entity, lacking in transparency, and are unclear about the payouts and when you can expect to receive them.

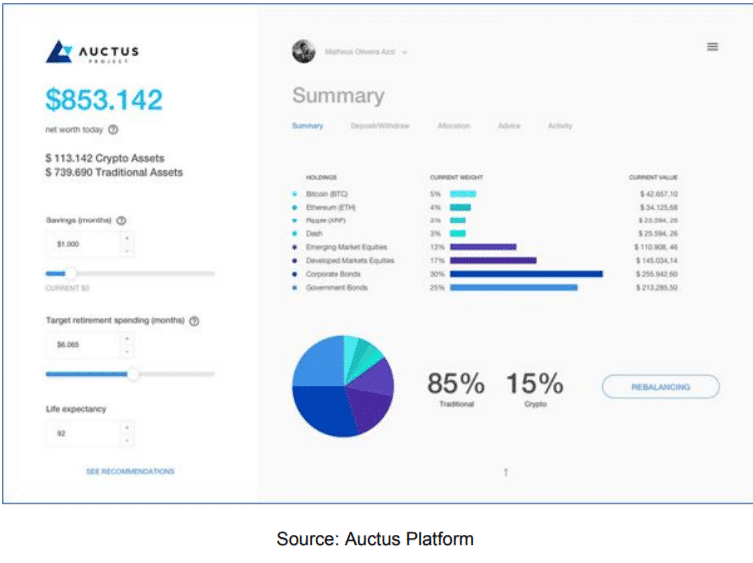

Actus is working to resolve these problems and make saving for retirement easier by using smart contracts to cut out middlemen and create transparency. Savers can hold a portfolio of investments designated to their retirement, from regulated 401k/IRA plans to cryptocurrency investments.

The aim is to place the decision-making back in the hands of the saver, rather than some faceless fund manager in a large corporation. It will also incentivize younger people to save for their future.

Purchase Bitcoin with Your 401k or IRA

Claiming to ensure the safe transfer of your retirement funds into an account for Bitcoin, Ethereum, Bitcoin Cash, and a number of other major cryptocurrencies, this lets new digital investors take a more active role in saving for retirement.

It also makes saving for old age more appealing, since, let’s face it, the prospect of a retirement home, hearing aid, and false teeth, isn’t exactly sexy.

As with any investments though, it may not be a wise idea to use all your savings to do this. Placing the fate of your golden years at the mercy of a bullish or bearish market could be a little stressful as you slide into retirement.

[thrive_leads id=’5219′]

Cryptocurrencies for Retirees

GladAge is an Australian blockchain company, looking to tackle the aging population in that corner of the world. Yet, if it turns out to be successful, it’s a model that can be rolled out across the globe.

“It’s also helpful to build micro-economies where all the transactions can be tracked more efficiently. This assists in monitoring the impact more accurately and to route the investments towards activities with highest possible impact,” Kapoor states.

No one wants to end up in a care home, but we don’t always have control over the course our lives take. So it’s comforting to know that we may be able to at least have a say–and a stake–in the quality of our care with cryptocurrencies for retirees, varied investment portfolios, and the chance to do more with our 401ks.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.